Aml Risk Definition

The concept of cash laundering is essential to be understood for these working in the financial sector. It's a process by which dirty money is converted into clean money. The sources of the cash in actual are felony and the money is invested in a means that makes it look like clean money and hide the id of the prison a part of the cash earned.

While executing the financial transactions and establishing relationship with the new prospects or maintaining present prospects the obligation of adopting sufficient measures lie on each one who is part of the group. The identification of such aspect in the beginning is straightforward to take care of instead realizing and encountering such situations afterward within the transaction stage. The central financial institution in any country offers complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such situations.

Virtual currencies offer an innovative cheap and flexible method of payment. Rather patients should be.

Anti Money Laundering And Counter Terrorism Financing

Risk levelScore Likelihood Impact.

Aml risk definition. Ad Search for results at TravelSearchExpert. 255 rows The theory supporting risk assessment tools and templates is based on the concept that a. Three levels of risk likelihood are shown in the sample table below.

Browse our site for relevant results and information. What is AML Anti-Money Laundering. A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in.

Find info on TravelSearchExpert. In core-binding factor CBF AML in particular in AML with t821 the presence of KIT mutations especially if higher mutant KIT levels are present appear to be associated with poorer prognosis. In a short period of time virtual currencies such as Bitcoin have developed into a powerful payment method with ever growing global acceptance.

Browse our site for relevant results and information. Key Definitions and Potential AMLCFT Risks. Ad Search for results at MySearchExperts.

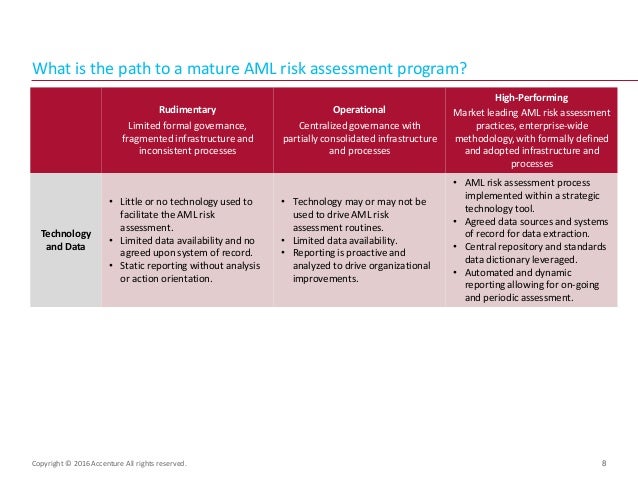

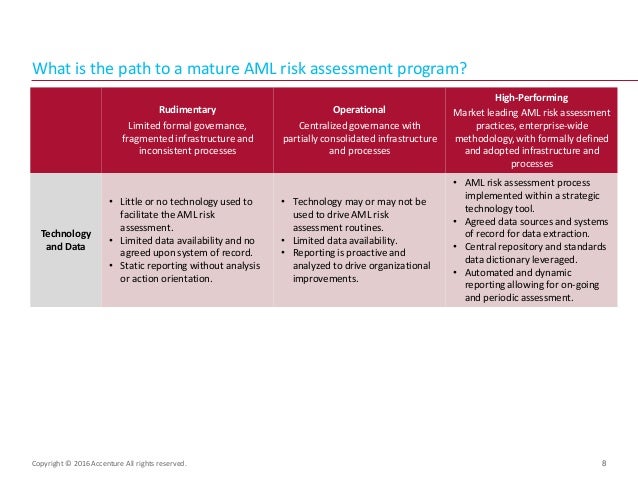

Financial institutions and other regulated entities are required to have a robust program to prevent detect and report money laundering. An anti-money laundering risk assessment measures risk exposure. The development of the BSAAML risk assessment generally involves the identification of specific risk categories eg products services customers and geographic locations unique to the bank and an analysis of the information identified to better assess the risks within these specific risk categories.

Ad Stay ahead of the game with search results from WebSearch101. Find info on MySearchExperts. 83-87 Nevertheless presence of a KIT mutation should not assign a patient to a different genetic risk category.

Find info on TravelSearchExpert. Updated over a week ago. A likelihood scale refers to the possibility or potential MLTF Risk occurring in the business for the particular risk being assessed.

Ad Stay ahead of the game with search results from WebSearch101. Risk is a combination of likelihood and impact. Ad AML coverage from every angle.

Latest news reports from the medical literature videos from the experts and more. Ad Search for results at TravelSearchExpert. Such an approach acknowledges the realities of the methods of laundering the proceeds of corruption.

Latest news reports from the medical literature videos from the experts and more. AML scheme requires an assessment of corruption-related risk and protecting against the laundering of corruption proceeds across the spectrum of customers and business relationships regardless of whether a FATF-defined PEP is involved. Ad AML coverage from every angle.

The universal definition of risk is this. Anti-Money Laundering controls seek to stop financial criminals from disguising illegally obtained funds as legitimate ones.

Infographic Money Laundering Is The Process By Which Criminals Conceal The Original Source Of Money To Make It Appear As It S Been Earned Via A Legitimate

Get Our Image Of Anti Money Laundering Policy Template For Free Policy Template Money Laundering Policies

Aml Ctf Risk Assessment On Legal Person And Gap Analysis On Ultimate

Pin By Victor On Risk Management Risk Analysis Risk Management Analysis

Pin By Peter Moore On Risk Management Risk Management Project Management Project Risk Management

Anti Money Laundering Aml Risk Assessment Process

Anti Money Laundering And Counter Terrorism Financing

Infographic The Six Steps Of The Nist Risk Management Framework Rmf Security Boule Risk Management Cyber Security Education Systems Development Life Cycle

Aml Cft Process Simplified Risk Assessment Part 1 Risk Management Never Been So Simplified

Financial Crime Risk Assessment Acams Today

Anti Money Laundering And Counter Terrorism Financing

This Animated Powerpoint Slide Depicting The Risk Management Framework Is An Essential Tool Risk Management Management Degree Project Management Professional

Pin On The Best Template Example

The world of regulations can look like a bowl of alphabet soup at times. US money laundering regulations aren't any exception. We've compiled a listing of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting firm focused on defending financial providers by decreasing risk, fraud and losses. We've big financial institution expertise in operational and regulatory risk. Now we have a robust background in program administration, regulatory and operational risk as well as Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many adverse consequences to the group due to the risks it presents. It increases the likelihood of major risks and the opportunity cost of the bank and in the end causes the bank to face losses.

Comments

Post a Comment